TL;DR:

- Surprise medical costs arise when billing from out-of-network providers occurs unexpectedly, often during emergencies.

- Approximately 39% of insured nonelderly adults experience surprise bills.

- Key causes: lack of transparency, insurance loopholes, missing pre-approvals, and out-of-network emergency services.

- Typical charges include emergency room fees, lab tests, and specialist costs.

- The No Surprises Act, effective January 1, 2022, protects patients by ensuring they pay only in-network costs for emergency services.

- Tips to avoid surprise bills: verify provider status, understand insurance policies, and request itemized bills.

- Direct Primary Care (DPC) offers predictable costs and transparent pricing to minimize surprises.

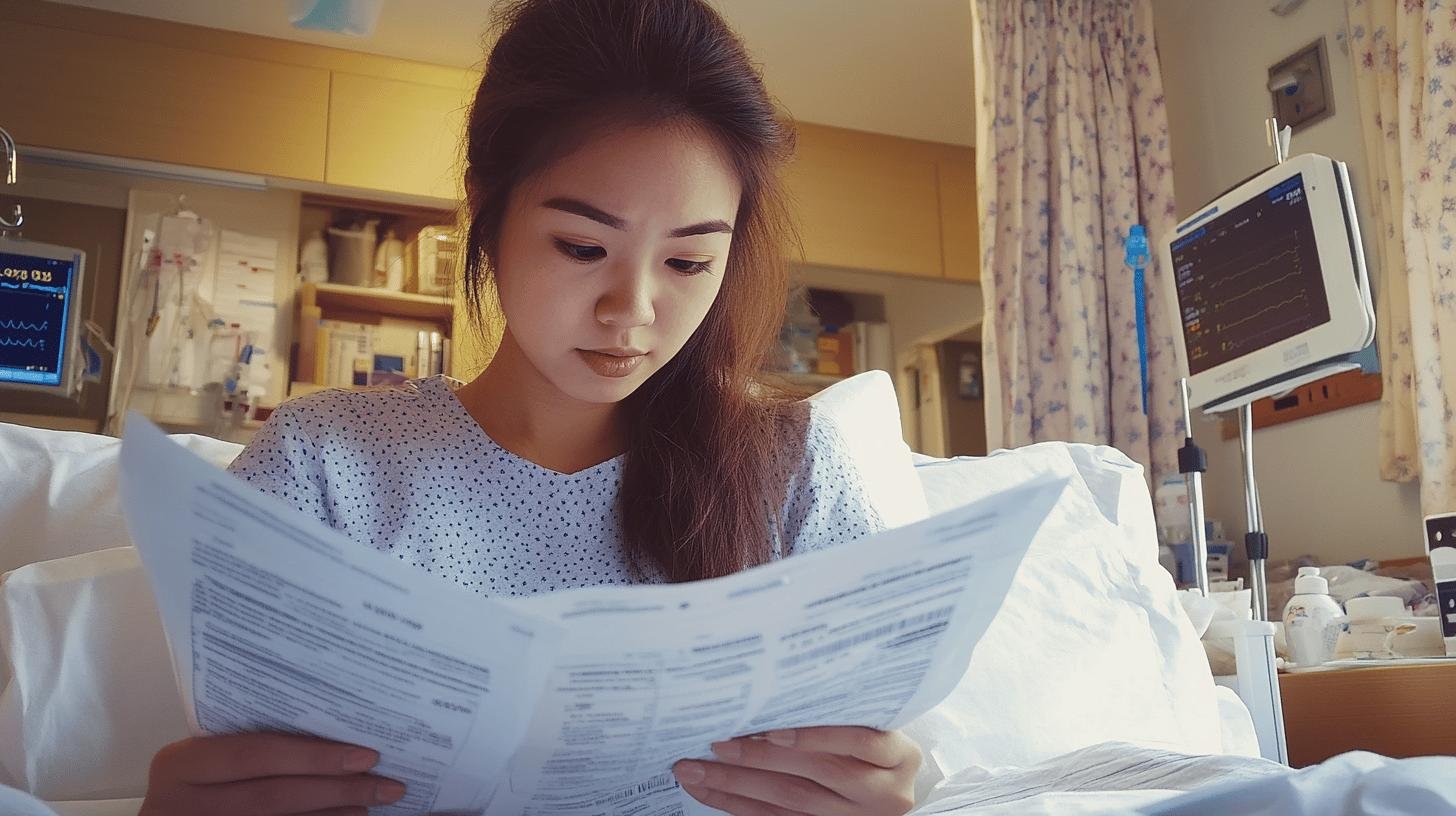

What Is Surprise Medical Cost? Have you ever opened a medical bill and felt like you walked into a haunted house? That’s what’s called a “surprise medical cost.” It’s not as fun as Halloween, that’s for sure. These pesky, unexpected bills sneak up when you least expect them, often from out-of-network providers you didn’t know were in the mix. Imagine finding out that 39% of folks with insurance still get slammed with these surprise charges—that’s scary! In this post, we’ll unravel the mystery behind these costs and arm you with the knowledge to dodge them for good. Let’s dig in!

What Is Surprise Medical Cost? Avoid Hidden Fees

Surprise medical costs are unexpected expenses you face when receiving healthcare. For instance, you might get a bill from a hospital or doctor not in your insurance network without warning. These costs often occur when you receive care from out-of-network providers without notice, especially during emergencies.

Imagine being rushed to the ER, focused on your health. Later, you discover your insurance doesn’t cover the attending physician. The resulting bill can be a huge shock. It can also happen if lab tests go to out-of-network providers or your hospital uses out-of-network specialists.

Approximately 39% of insured nonelderly adults report getting surprise bills, with 10% from out-of-network providers. Such situations can lead to stress and financial strain, turning a medical event into a financial burden. Knowing the potential for such costs can help you avoid shockingly high medical bills.

Causes of Surprise Medical Bills

Surprise medical bills often feel like a punch to your wallet, mainly due to out-of-network charges. You think you’re covered, but a surprise bill arrives when an out-of-network provider is involved. This is particularly common during emergencies when checking each doctor’s network status is challenging. These charges can lead to unexpected, significant expenses.

What else can cause these surprise bills? Here are some common reasons:

- Lack of Transparency: It’s sometimes unclear if a provider is in-network.

- Insurance Coverage Loopholes: Not everything is covered, as you might assume.

- Missing Pre-approvals or Referrals: These can result in denied claims.

- Emergency Room Services: Even in-network hospitals can have out-of-network providers.

Surprise billing is common—about 18% of emergency visits lead to unexpected charges, translating to nearly one in five visits. These bills cause stress and financial strain, turning healthcare challenges into financial dilemmas. Understanding these causes can help you navigate the healthcare system more effectively.

The Financial Impact of Surprise Medical Costs

Surprise medical costs can crush your budget. Imagine opening a $2,000 or more bill after a visit. That’s a harsh reality for many. Nearly 40% of U.S. adults struggle to cover even a $400 unexpected bill, so these costs can create a heavy financial burden.

Here’s a look at typical charges you might encounter:

- Emergency room fees

- Out-of-network specialist charges

- Lab tests at non-covered providers

- Extra anaesthesia service costs

These surprise bills can also harm your credit score. If unpaid, they can go to collections, affecting your credit badly. This can complicate getting loans, buying a house, or renting an apartment.

Unexpected medical expenses can force you to dip into savings, delay purchases, or affect your ability to pay for essentials. It’s not just a financial issue—it’s stressful and life-altering. Being informed can help you plan better and avoid some of this financial strain.

How Regulatory Measures Aim to Protect Patients

The No Surprises Act, effective January 1, 2022, aims to protect patients from unexpected medical bills. It acts as a safety net when you need emergency services. The law ensures you’re only charged up to your in-network cost-sharing amount. Prior to this, you might have been blindsided by out-of-network charges. This Act significantly reduces financial stress for patients nationwide, covering around 10 million surprise bills annually.

Key Protections Under the No Surprises Act

The Act provides several key protections. Patients pay only the in-network cost-sharing, even when treated by out-of-network providers. You receive a clear picture of what you owe for any medical service. The Act also mandates providers and facilities to give advance notice if they’re out-of-network, along with an estimated cost. This means fewer surprises when receiving your bill.

Enforcement and Compliance

Federal and state agencies enforce the Act, ensuring compliance. Penalties for non-compliance can be steep, encouraging adherence to the guidelines. The federal government leads enforcement, but states contribute, especially when state laws apply, ensuring patients avoid financial traps.

These regulations reduce patient billing stress and promote fairer, more transparent healthcare billing. Being informed about costs upfront allows patients to focus on recovery rather than battling confusing bills.

Tips to Prevent and Manage Surprise Medical Costs

Want to avoid those sudden medical bills? Be proactive. Start by thoroughly understanding your insurance policies. Know what’s covered to avoid nasty surprises. Double-check if providers are in-network before appointments. A quick call to your insurance company can prevent future headaches.

Here’s a handy table to keep these tips at your fingertips:

| Action | Benefit |

|————————————|—————————————–|

| Verify provider network status | Avoid out-of-network charges |

| Understand insurance policies | Know what services are covered |

| Request itemized bills | Catch errors and unnecessary charges |

| Discuss treatment plans | Ensure services are covered and necessary |

If a surprise bill does appear, communicate. Talk with healthcare providers about unexpected charges and request itemized bills to check for errors. Keep your insurance company updated; they might help dispute or clarify charges. Staying informed helps you manage surprise bills better, possibly saving you money.

Advantages of Direct Primary Care in Reducing Surprise Costs

Direct Primary Care (DPC) is like a healthcare subscription. You pay a regular membership fee, covering many primary care services. With no insurance companies involved, DPC is hassle-free—you don’t wrestle with claims or approvals. You know exactly what you’re paying, making budget planning easier.

Here are DPC’s perks:

- Predictable Costs: Know your costs upfront, minimizing surprise bills.

- No Insurance Involvement: Avoid dealing with insurance complexities.

- Unlimited Access: More time with your doctor without cost worries.

- Transparent Pricing: Clear service costs make budgeting easier.

DPC eliminates surprise billing through clear pricing. You know what you’re getting and paying for upfront, eliminating unexpected charges.

Why consider DPC for managing healthcare expenses? It delivers transparency and control, free from insurance networks and visits limits. You can focus on health without worrying about hidden costs. Personalized care also means catching health issues early and reducing expensive interventions later. DPC is about affordable, stress-free healthcare.

Final Words

Surprise medical costs can sneak up on us when least expected, especially with those pesky out-of-network charges. We dove into how these unexpected healthcare expenses often bind many financially.

Regulatory measures, like the No Surprises Act, offer a glimmer of hope, protecting against these sneaky bills. But being proactive—understanding your insurance, confirming provider networks, and considering models like Direct Primary Care—can be your best defence.

Stay informed and take steps to sidestep unexpected charges. With these tools and vigilance, you can keep surprise medical costs at bay!

FAQ

What is the surprise medical cost in 2021?

A surprise medical cost in 2021 refers to unexpected healthcare expenses that occur when you get care from out-of-network providers without realizing it, often during emergencies.

What is an example of surprise billing in healthcare?

An example of surprise billing is being treated by an out-of-network doctor during an emergency room visit and receiving a hefty bill.

Are surprise hospital bills illegal?

Surprise hospital bills are not entirely illegal but are restricted under certain laws like the No Surprises Act, depending on the state and type of service.

How do I dispute a surprise medical bill in Texas?

To dispute a surprise medical bill in Texas, contact your insurer to initiate an appeal and work with healthcare providers for a dispute resolution.

What is the No Surprises Act?

The No Surprises Act, effective January 1, 2022, protects against surprise billing for emergency services, capping charges at in-network rates for many situations.

To whom does the No Surprises Act apply?

The No Surprises Act applies to patients receiving emergency services and certain non-emergency services from out-of-network providers at in-network facilities.

What is the No Surprise Medical Bill Act in Florida?

In Florida, the No Surprises Act ensures patients aren’t charged out-of-network rates for emergency services and certain non-emergency services at in-network facilities.

Received medical bill 2 years later?

Due to billing errors or delays, a medical bill can be received years later. It’s best to contact the healthcare provider or insurer to confirm and possibly dispute the bill.

Received medical bill 1 year later?

Receiving a medical bill a year later might be due to processing delays. You should verify its validity with the provider and inquire about financial assistance or dispute options.

What are surprise billing laws by state?

Surprise billing laws vary by state and may include measures to prevent surprise bills, like requiring clearer billing disclosures and limiting out-of-network charges.